How do I know when the "right" time to sell is?

Waiting for the "right market" to sell your small business tends to be a mistake.

Many small-business owners delay selling because they're waiting for ideal conditions: stronger economic growth, a rising stock market, lower interest rates. They assume these factors will boost their valuation.

The problem? Data shows those conditions barely move the needle.

Across more than a decade of Main Street M&A activity, small business valuations have remained remarkably consistent at roughly 2.5–3x Seller's Discretionary Earnings (SDE). That stability has held through recessions, bull markets, interest-rate shocks, and COVID-era volatility.

In other words: the perfect market probably doesn't exist—and it doesn't need to.

The Data: Small Business Valuations Are Surprisingly Stable

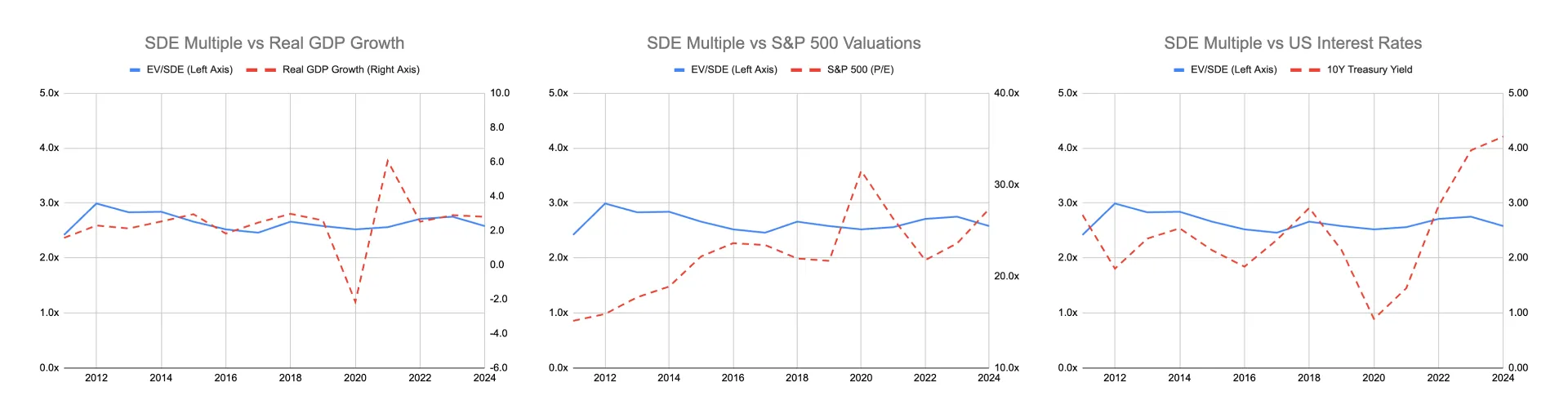

Analysis we performed on 10,000+ Main Street transactions reveals a flat, predictable valuation trend. When you map average multiples against major macroeconomic indicators—U.S. real GDP growth, S&P 500 P/E ratios, and 10-year Treasury yields—three patterns emerge:

- Valuations aren't tied to economic cycles: Even during major disruptions—COVID lockdowns, rapid recoveries, inflationary surges—multiples barely moved. Main Street deals remained within the 2.5–3x SDE range.

- Valuations don't correlate with public markets: Stock valuations for the S&P 500 have virtually no relationship to small, privately held business valuations.

- Valuations show limited sensitivity to interest rates: Despite dramatic rate hikes from 2022–2024, transaction multiples didn't materially compress.

Why the "Right Market" Is the Wrong Strategy

The data is clear: macro conditions don't meaningfully shift the valuation you're likely to receive.

Two practical implications:

- Your personal timing matters more than the economic cycle. If your business is performing well, you have clean financials, and (most importantly!) you're ready to exit—that's often the optimal moment. Not some hypothetical future environment.

- Trying to time the market creates unnecessary delay. Many owners wait one year, then another, then another. By the time they re-engage, performance has slipped, the team has changed, or burnout has set in—all of which damage valuation far more than GDP or interest rates ever will.

What This Means for Buyers and Sellers

The lesson is straightforward: focus on what you can control.

Not the stock market. Not the Fed. Not next quarter's GDP.

The real drivers of valuation—cash-flow quality, customer concentration, operational systems, financial reporting, transition risk—are internal, not macroeconomic.

For most owners, the best time to sell is when it aligns with your goals, your readiness, and your business's performance—not when you think the broader market is "right."

Final Takeaway

The idea that you need perfect market conditions to sell is a myth. Main Street valuations have been steady, predictable, and resistant to macro trends for over a decade.

If you're planning an exit or just exploring options, timing the economy matters far less than timing your own readiness.